Loan Service Providers: Your Trusted Financial Partners

Loan Service Providers: Your Trusted Financial Partners

Blog Article

Check Out Expert Car Loan Providers for a Seamless Loaning Experience

In the world of financial transactions, the quest for a smooth loaning experience is often sought after yet not quickly obtained. Expert car loan services offer a path to navigate the complexities of loaning with precision and know-how. By lining up with a trustworthy financing copyright, individuals can unlock a plethora of advantages that extend past mere financial deals. From customized financing options to individualized support, the world of specialist car loan solutions is a realm worth checking out for those seeking a borrowing trip marked by effectiveness and ease.

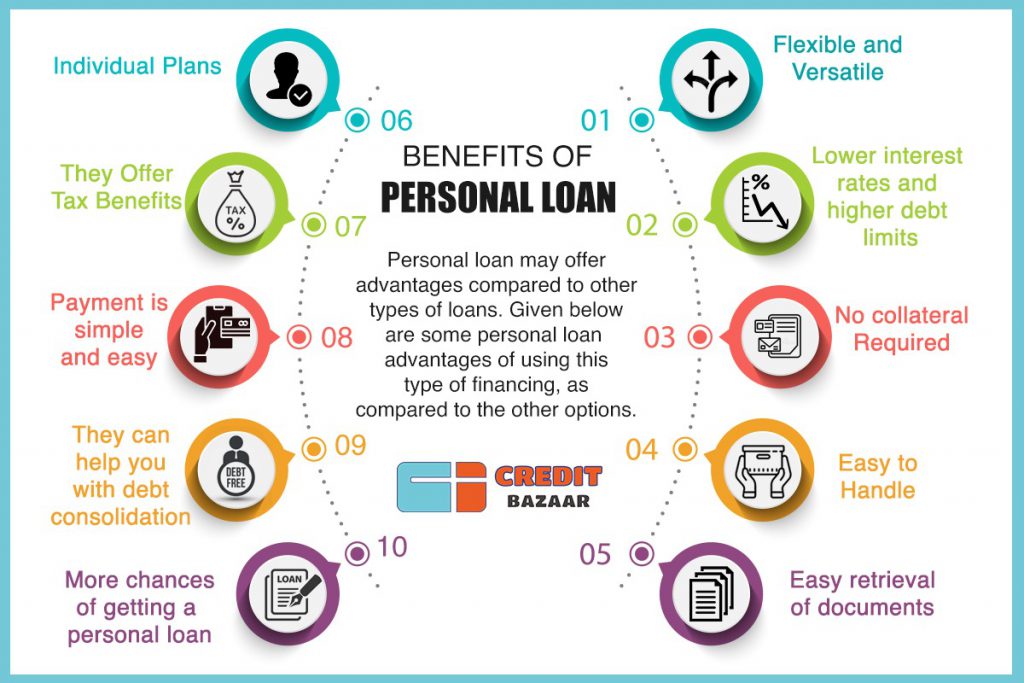

Benefits of Expert Loan Solutions

Specialist financing solutions use experience in browsing the complicated landscape of borrowing, providing customized services to meet certain monetary needs. Specialist funding solutions typically have developed connections with loan providers, which can result in faster approval processes and much better negotiation end results for borrowers.

Choosing the Right Lending Supplier

Having identified the benefits of expert funding services, the following important action is picking the ideal funding service provider to fulfill your particular financial demands efficiently. best business cash advance loans. When choosing a financing service provider, it is vital to think about a number of essential elements to ensure a seamless borrowing experience

Firstly, evaluate the reputation and reputation of the funding supplier. Research study client evaluations, ratings, and reviews to assess the fulfillment levels of previous customers. A respectable funding copyright will certainly have transparent terms and conditions, superb client service, and a performance history of reliability.

Second of all, compare the interest prices, fees, and repayment terms supplied by different lending providers - mca loan companies. Seek a provider that provides competitive rates and versatile settlement options tailored to your financial situation

Additionally, consider the funding application procedure and authorization duration. Select a copyright that offers a structured application procedure with fast authorization times to gain access to funds immediately.

Improving the Application Process

To enhance efficiency and benefit for applicants, the loan provider has actually applied a streamlined application process. This polished system aims to streamline the borrowing experience his explanation by minimizing unneeded documents and expediting the authorization process. One essential feature of this streamlined application procedure is the online platform that allows candidates to submit their information digitally from the comfort of their very own homes or offices. By removing the requirement for in-person check outs to a physical branch, applicants can conserve time and complete the application at their convenience.

Recognizing Car Loan Conditions

With the structured application process in place to streamline and expedite the loaning experience, the next vital step for candidates is acquiring a thorough understanding of the funding terms and problems. Comprehending the terms and problems of a lending is important to ensure that customers are mindful of their obligations, rights, and the total cost of loaning. By being educated about the finance terms and conditions, customers can make audio monetary choices and browse the borrowing process with confidence.

Taking Full Advantage Of Lending Approval Possibilities

Safeguarding approval for a funding demands a calculated strategy and comprehensive preparation for the debtor. To make the most of lending authorization possibilities, individuals must begin by examining their credit reports for accuracy and dealing with any type of inconsistencies. Keeping a good credit report rating is critical, as it is a substantial variable considered by lenders when evaluating creditworthiness. Additionally, reducing existing debt and preventing handling new financial obligation prior to obtaining a lending can demonstrate financial responsibility and boost the chance of authorization.

In addition, preparing an in-depth and sensible budget that lays out earnings, expenditures, and the suggested car loan repayment strategy can showcase to loan providers that the borrower can managing the added economic commitment (mca direct lenders). Giving all essential documents quickly and accurately, such as proof of income and work background, can simplify the approval procedure and instill confidence in the lending institution

Final Thought

Finally, professional financing solutions use different benefits such as experienced guidance, customized financing alternatives, and boosted approval chances. By picking the appropriate financing provider and recognizing the conditions, customers can simplify the application procedure and make sure a seamless loaning experience (Loan Service). It is essential to carefully think about all elements of a funding before devoting to make sure financial security and effective payment

Report this page